Please wait. We are saving your currency.

Please wait. We are saving your currency. Please wait. We are saving your currency.

Please wait. We are saving your currency.Code copied!

Please wait. We are saving your currency.

Please wait. We are saving your currency.

Let’s be real: budgeting sounds about as fun as watching paint dry. But if you want to keep your wallet happy and still treat yourself without guilt, having a solid monthly budget is your secret weapon. And here’s the twist—combine that with cashback sites like MENA Cashback, and boom! You’re not just saving money; you’re making money back on the stuff you buy anyway.

Ready to level up your financial game? Let’s dive in.

|

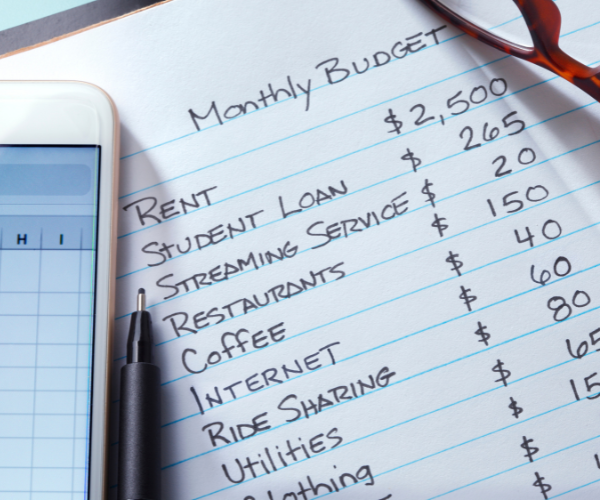

Step 1: Track Your Expenses Like a ProFirst thing’s first: You can’t budget what you don’t know. For one month, jot down everything you spend — from your morning coffee to that random Amazon splurge at 2 a.m. (No judgment, we all do it). Use apps, spreadsheets, or good old pen and paper—whatever works. The key is to get clear visibility on your income versus outgoings. |

|

Step 2: Categorize and Prioritize Your SpendingOnce you have your spending list, group expenses into categories: rent, groceries, transportation, entertainment, and so on. Then, figure out which ones are essentials and which ones are “nice-to-haves.” This clarity helps you see where you can trim without feeling deprived. Spoiler: You might find some sneaky subscriptions or impulse buys draining your cash. |

|

Step 3: Set Realistic Limits & GoalsNow that you know where your money goes, set spending limits per category for the next month. Don’t go crazy—make it achievable so you stick with it. And here’s the fun part: Set a savings goal. Even if it’s just $50/month, consistency pays off big time. Remember, budgeting is not about restriction; it’s about control. |

|

Step 4: Use Cashback to Stretch Your BudgetHere’s where MENA Cashback turns your budgeting from boring to brilliant. When you shop online through menacashback.com, you earn a percentage of your spend back as cold, hard cash. Think about it: every grocery order, fashion haul, or tech upgrade can return some of your money. It’s like your budget’s secret bonus round. |

|

Step 5: Make Cashback Part of Your RoutineBookmark MENA Cashback, sign up, and always start your online shopping journey there. The platform covers tons of popular stores in the MENA region, so there’s no excuse to miss out. Plus, MENA Cashback often offers sign-up bonuses and special deals — perfect for boosting your savings from day one. |

|

Step 6: Monitor and Adjust MonthlyYour budget isn’t set in stone. Each month, review your spending and cashback earnings. Celebrate wins and adjust categories or limits if something isn’t working. With practice, budgeting becomes second nature — and watching your cashback pile grow is downright motivating. |

Budgeting without cashback is like having a gym membership but never going. Cashback without budgeting is like running on a treadmill going nowhere.

Together, they create a powerful combo: Budget to control your spending, cashback to maximize your rewards. You shop smart, save more, and actually enjoy the process.

Head over to menacashback.com now, create your free account, and start earning cashback on your everyday purchases. Your future self will thank you.

Happy budgeting — and happier saving!

Cashback MENA © 2025 All rights reserved.